- close

- Home

-

Banking

- Accounts & Deposits

- Local Currency Accounts

- Foreign Currency Accounts

- Time Deposits

- Open a Banking Account

- Promotions

- Citi Priority

- Citigold

- Citigold Private Client

- Global Banking

- Moving to Singapore

- Global Investment Opportunities

- Travelling Overseas

- Living Overseas

- Managing my Global Accounts

- Recommend a Friend

- Citibank Debit Mastercard

- CitiBusiness

- Cash Management

- Loans

- Trade

- Treasury

- CitiBusiness Online

- Forms

- Citi At Work

- Citi Commercial Bank

-

Credit Cards

- View all cards

- Travel

- Rewards

- Cashback

- Student

- Business

- Supplementary Card

- Refer your friend & get $50

- Commercial Cards

- View all privileges

- Citi World Privileges

- Citi Thank YouSM Rewards

- Citi Rebates & Instant Rewards

- Petrol deals

- 0% Instalment Plan

- Additional services

- Pay your bills

- Manage your card

- Activate your card

- Increase your credit limit

- Mobile payments

- Visa checkout

- Submit CPF

- EZ-Pay

- Electricity Bills

- Mortgages

-

Loans

- Your Personal Loan Solutions

- Debt Consolidation Plan

- Personal Loan

- Balance Transfer

- Paywise

- Ready Credit Products

- Ready Credit

- Ready Credit Card

- Debt Consolidation Plan

- Citibank Ready Credit Paylite

- Apply for Citibank Ready Credit

- Additional services

- Activate your Ready Credit Card

- Manage your Ready Credit Account

- Increase your Credit Limit

- Repayment modes

- Credit Insure Insurance

- Ready Credit Tools & Calculators

- Mobile payments

- Insurance

-

Wealth Management

- Investment products

- Unit Trusts

- Fixed Income Securities

- Foreign Exchange

- Citibank Premium Account

- Citibank Brokerage

- Citi Priority

- Citigold

- Advisory

- Wealth Solutions

- Your Team

- Privileges and Offers

- Citigold Private Client

- Wealth Management Products

- Wealth Advisory

- Privileges

- Citibank International Personal Bank

- Home

-

Banking

- Accounts & Deposits

- Local Currency Accounts

- Foreign Currency Accounts

- Time Deposits

- Open a Banking Account

- Promotions

- Citi Priority

- Citigold

- Citigold Private Client

- Credit Cards

- Mortgages

- Loans

- Insurance

- Wealth Management

- Home

- Banking

- Instant Access

- Online & Mobile Services

- Mobile Services

- Download Citi Mobile App

You can now do even more.

We’ve updated the Citi Mobile® App to include an all new experience

It’s quicker, it’s easier to use, and it’s the app that’s all about you

Enjoy control of your card and banking matters, whenever and wherever you go

Find out what makes managing your credit cards and banking so simple

Our customers’ favourite features

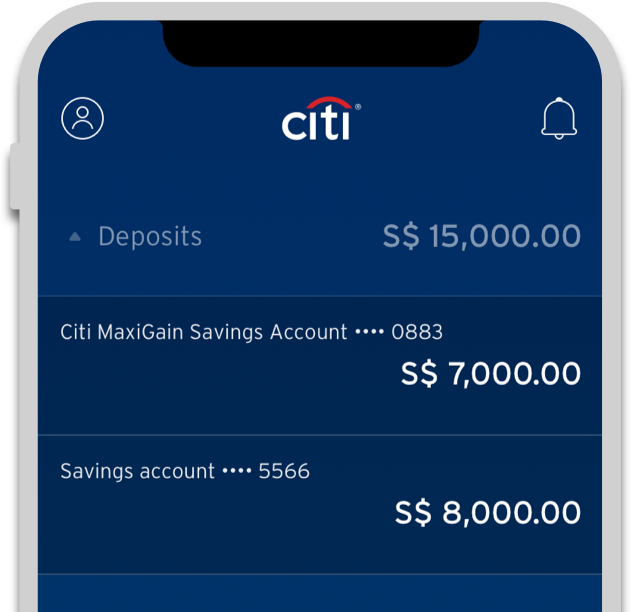

Personalised dashboard

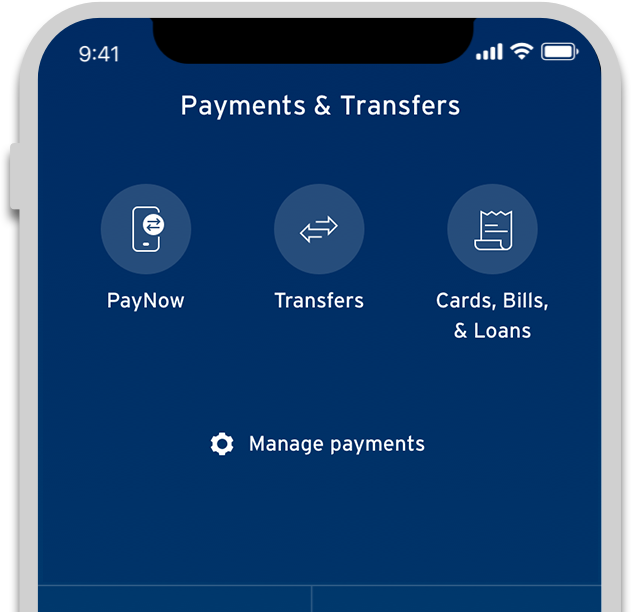

Simplify your payments

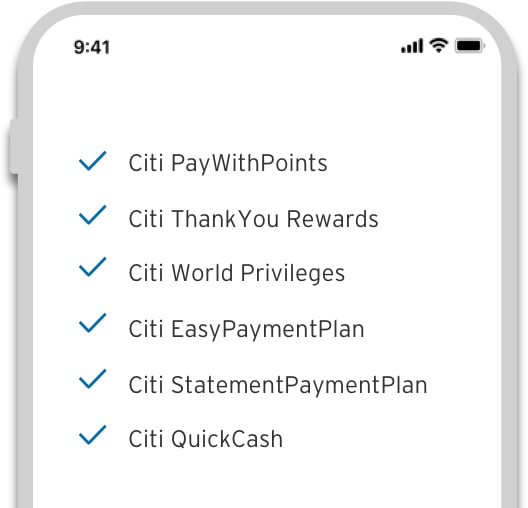

Powerful features on demand

Your security is our priority

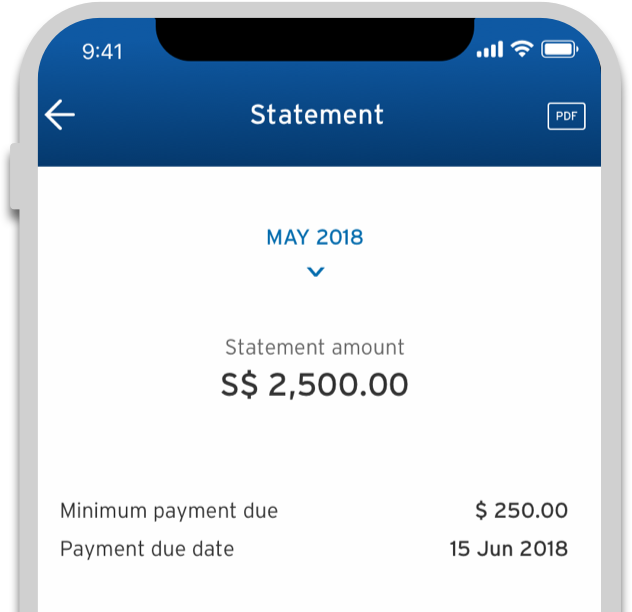

Credit Cards eStatement

Activate & manage your card

All new features on the Citi Mobile® App

Citi Pay With Points

Use your Points or Miles to offset your transactions instantly

Citi World Privileges

Get deals and discounts locally and in 95 other countries

Quick Cash

Instant# cash from your credit card, on your terms

PayAll

Turn big payment into your big rewards

Frequently Asked Questions

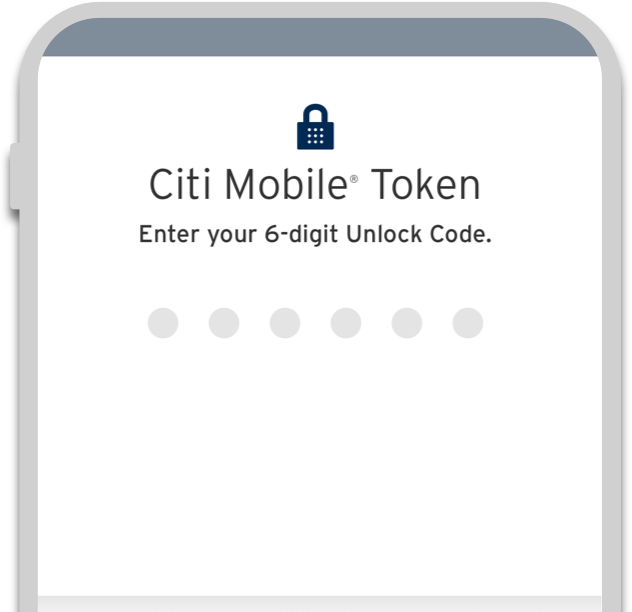

- What is Citi Mobile® Token?

It is a feature within the Citi Mobile® App that authenticates transactions, as an alternative to other authentication methods such as Online Security Device, or SMS One-Time PIN (OTP). You may still use your Online Security Device or SMS OTP to authenticate transactions. Please note that your Citi Mobile® Token can only be used with this app and is paired only to one device.

- What are the benefits of Citi Mobile® Token?

SECURE

Protected by a 6-digit Unlock Code chosen by you, and restricted to one mobile device of your choice.INSTANT

Enter your unique Unlock Code to instantly authenticate your transactions initiated in this app. No more waiting for SMS OTPs or worrying about misplacing your Online Security Device.EASY

Authenticates all online transactions such as payments and transfers, adding a new payee, and updating your contact details. It also generates OTPs for online purchases. - I lost my mobile phone. How do I disable Citi Mobile® Token?

There are three ways to do it:

1. Log in to your Citibank Online account and follow this path: Services > My Profile > De-activate Citi Mobile® Token.

2. Enable Citi Mobile® Token on another mobile device. Citi Mobile® Token will automatically be disabled on the mobile phone you lost.

3. Call CitiPhone Banking at (65) 6225 5225.

- I have a new mobile device. How do I enable Citi Mobile® Token in my new device?

Simply enable the Citi Mobile® Token on your new mobile device, the Citi Mobile® Token will be automatically deactivated on the previous device.

You can enable Citi Mobile® Token in 4 steps:

Step 1: Sign on to Citi Mobile® App.

Step 2: Select the “Profile” button located in the top left hand corner > Under “Security Settings” select “Manage Citi Mobile Token”

Step 3: Select Unlock Code and key in OTP sent to your mobile via SMS.

Step 4: Create your 6-digit Unlock Code.

You have successfully enabled the Citi Mobile® Token. - I have entered my 6-digit Unlock Code incorrectly three times (or more). What can I do if I'm unable to proceed?

For assistance, please call your Relationship Manager or CitiPhone Banking at (65) 6225 5225.

- Can I use the Citi Mobile® Token in my old mobile device after enabling Citi Mobile® Token in my new mobile device?

No, you will not be able to generate One-Time PIN (OTP) and / or Transaction Authorisation Code (TAC) on the old device to authenticate your transactions. For security reasons, you can register for Citi Mobile® Token in one device only. If you have enabled the Citi Mobile® Token on a new device, the Citi Mobile® Token in the previous device will be automatically disabled.

- When can I use the Citi Mobile® Token?

Citi Mobile® Token can be used in the following scenarios:

Citi Mobile® App

Authenticate instantly with your unique Unlock Code for all transactions initiated in the Citi Mobile® App on your Citi Mobile® Token enabled device.Citibank Online

Instantly generate an OTP or Transaction Authorization Code (TAC) with your unique Unlock Code, to authenticate all transactions on Citibank Online.

When making payment for online purchases

Instantly generate a One-Time PIN (OTP) with your unique Unlock Code for online purchases. - How do I enable Citi Mobile® Token?

You can enable Citi Mobile® Token in 4 steps:

Step 1: Sign on to Citi Mobile® App.

Step 2: Select the “Profile” button located in the top left hand corner > Under “Security Settings” select “Manage Citi Mobile Token”

Step 3: Select Unlock Code and key in OTP sent to your mobile via SMS.

Step 4: Create your 6-digit Unlock Code.

You have successfully enabled the Citi Mobile® Token. - Why do I need to create a 6-digit Unlock Code in order to use Citi Mobile® Token?

The unique Unlock Code ensures that only you have access to Citi Mobile® Token on your device and can generate a One-Time PIN (OTP) and / or Transaction Authorisation Code (TAC). Please remember your Unlock code and do not share it with anyone.

- Can I still use my Online Security Device or get One-Time PIN (OTP) via SMS after enabling Citi Mobile® Token?

Yes, you can still use your Online Security Device or get OTP via SMS. However, with the Citi Mobile® Token, if you are making transactions in the Citi Mobile® App on your Citi Mobile® Token enabled device, authentication is instant when you enter your unique Unlock Code. There's no need to wait for OTP via SMS, or worry about misplacing your Online Security Device.

- Why am I not able to see the option to use Online Security Device or an option to generate One-Time PIN (OTP) via SMS to authenticate my transaction in Citi Mobile® App?

Once you have registered for the Citi Mobile® Token, it becomes your primary mode of authentication for all transactions made through the Citi Mobile® App. The option to use Online Security Device or OTP via SMS will be made available only if your authentication via the Citi Mobile® Token is unsuccessful.

- How do I use Citi Mobile® Token when performing transactions in the Citi Mobile® App on my Citi Mobile® Token enabled device?

Select your intended transaction on Citi Mobile® App.

Enter your 6-digit Unlock Code when prompted.

Once the authentication is successful, your selected transaction will be automatically completed. - How do I use Citi Mobile® Token to generate a One-Time PIN (OTP) for banking transactions done on Citibank Online or online purchases that requires payment authorisation?

Generate OTP with the following steps:

Step 1: Select "Citi Mobile® Token" at the login screen.

Step 2: Enter your 6-digit Unlock Code.

Step 3: Enter the OTP generated by Citi Mobile® Token where requested to complete your transaction. - I have enabled the Citi Mobile® Token on my mobile device. Am I able to use my Citi Mobile® Token to perform a transaction on another mobile device?

Yes, you would be able to do so with the following steps:

Step 1: Launch the Citi Mobile® App on your other mobile device. An OTP screen will be displayed when you are attempting to perform a transaction and/or activity that requires an OTP.

Step 2: On your Citi Mobile® Token enabled device, select "Citi Mobile® Token" at the login screen.

Step 3: Enter your 6-digit Unlock Code.

Step 4: An OTP will be generated by the Citi Mobile® Token; enter this OTP on the OTP screen of your other mobile device where your transaction and/or activity is performed.

Your transaction and/or activity will be completed upon the successful authentication of the OTP. - How do I use the Citi Mobile® Token to perform “Transfers” in the Citi Mobile® App on my Citi Mobile® Token enabled device?

Step 1: Enter the necessary transfer details. (You have the option to save the payee into the payee list)

Step 2: Enter 6-digit Unlock Code.

Step 3: The Citi Mobile® Token will automatically perform the Transaction Signing.

Once authentication is successful your payee will be added. - How do I use Citi Mobile® Token to generate Transaction Authorisation Code (TAC) for Transaction Signing done via Citibank Online?

For added security, a TAC is required for selected transactions such as:

Add Payee for payment and transferring funds

High Value Transfer & Payment

Change of demographic details

Sending a secured messageWhen Transaction Signing is required, please do the following instructions:

Step 1: Select "Citi Mobile® Token” on the login screen.

Step 2: Enter your 6-digit Unlock code.

Step 3: Enter the 10-digit Challenge Code from the Citibank Online Transaction Signing screen into the bar.

Step 4: The TAC will be generated.

Step 5: Enter the TAC where required. Then select "Continue" to complete your transaction. - I have enabled the Citi Mobile® Token on my mobile device. Am I able to use my Citi Mobile® Token to generate a Transaction Authorization Code (TAC) for Transaction Signing, on another mobile device?

Yes, you would be able to do so with the following steps:

Step 1: Launch the Citi Mobile® App on your other mobile device. A Transaction Signing screen will be displayed when you are attempting to perform a transaction and/or activity that requires a TAC.

Step 2: Tap on "Authenticate using Citi Mobile® Token". A 10-digit Challenge Code will be displayed on the screen.

Step 3: On your Citi Mobile® Token enabled device, tap on the "Citi Mobile® Token” button which may be found on the login screen of the Citi Mobile® App.

Step 4: Enter your 6-digit Unlock code.

Step 5: Enter the 10-digit Challenge Code displayed in your other mobile device into the input field located in the lower half of the screen.

Step 6: The TAC will be generated. Enter this TAC to the TAC screen of the other mobile device where your transaction and/or activity is being performed. - Can I use Citi Mobile® Token without Citi Mobile® App installed?

No, you will not be able to use Citi Mobile® Token without installing the Citi Mobile® App.

Click here to download the Citi Mobile® App. - I lost my mobile phone. How do I disable Citi Mobile® Token?

If you have lost your mobile phone, there are 3 ways to disable your Citi Mobile® Token:

1) Login to your Citibank Online account on your browser and follow these steps:

>Services > My Profile > Deactivate Citi Mobile® Token

2) By enabling Citi Mobile® Token on another mobile device,. Citi Mobile® Token will automatically be deactivated on the previous mobile device.

3) Call CitiPhone at +65 6225 5225 to deactivate your Citi Mobile® Token. - Why is my One-Time PIN (OTP) authentication unsuccessful?

Your OTP authentication may be unsuccessful because you have entered an incorrect Unlock Code. Please try again and note that entering an incorrect Unlock Code more than three times in a row will lock you out of Citibank Online and the Citi Mobile® App. Should you need assistance, please call our CitiPhone at +65 6225 5225.

If you have forgotten your Unlock Code, you can reset your Unlock Code by signing on to Citi Mobile® App and follow the steps below:

Step 1: Select "Profile" button from the top left hand.

Step 2: Select "Manage Citi Mobile® Token".

Step 3: Select "Reset Unlock Code".Alternatively, you can try to refresh your Citi Mobile® Token from Citi Mobile® App.

Step 1: Select "Profile" button from the top left hand.

Step 2: Select "Manage Citi Mobile® Token".

Step 3: Tap on Sync to refresh your Citi Mobile® Token. - I have entered the 6-digit unlock code incorrectly 3 times (or more) and I am not able to proceed further.

Please call your Relationship Manager or our CitiPhone hotline at +65 6225 5225 for assistance.

- I forgot my 6-digit Unlock Code, what do I do?

You can reset your Unlock Code by signing on to Citi Mobile® App and follow the steps below:

Step 1: Select "Profile" button from the top left hand.

Step 2: Select "Manage Citi Mobile® Token".

Step 3: Select "Reset Unlock Code".

- What is Touch ID / Face ID?

Touch ID / Face ID is a feature that enables login authentication based on fingerprints and Face Identification stored on your Apple iphone device; which is an alternative login mechanism to Citi's User ID and Password.

*Biometric authentication methods like Fingerprint Touch ID™ or facial recognition technology are proprietary to third parties and if you choose to use these methods, you need to do so in accordance with such third parties’ terms and conditions. If you choose to activate the biometric authentication function on the Citi Mobile® App, you will enable your biometric data (e.g. fingerprint or facial data) saved on your device to be used to access to the Citi Mobile® App. Accordingly, you should not activate the biometric authentication function, and to immediately de-activate such biometric authentication function, if any other person's biometric data is saved, whether now or in the future, on your device.

- Which phone models are eligible for Touch ID / Face ID activation?

Touch ID feature is available on Apple Mobile Phone Models 5S and newer. Face ID feature is available on Apple Mobile Phone Models X and newer. Android devices are not supported currently.

- How secure is Touch ID / Face ID?

Your fingerprint information is stored on your Apple device's Secure Element. Once you enable Touch ID / Face ID as a login method for your Citi Mobile® App, an encrypted token is created and stored in Citi Mobile® App and our Citi system. No login information is stored on the Citi Mobile® App.

- How to enable Touch ID / Face ID for Citi Mobile® App?

Step 1: Sign on to Citi Mobile® App.

Step 2: Select the “Profile” button located in the top left hand corner > Under Security Settings select “Touch ID / Face ID”

Step 3: Enable Touch ID / Face ID

Step 4: Key in your 6 digit unlock code or OTP sent to your mobile via SMS.

Your Touch ID / Face ID is enabled on your device. - How to disable Touch ID / Face ID for Citi Mobile® App?

Step 1: Sign on to Citi Mobile® App.

Step 2: Select the “Profile” button located in the top left hand corner > Under Security Settings select “Touch ID / Face ID”

Step 3: Disable Touch ID / Face ID - How long is my Touch ID / Face ID Sensor enrollment for Citi Mobile® App valid?

Enrollment of Touch ID / Face ID Sensor for Citi Mobile® App is valid for 45 days. If you have not logged into the Citi Mobile® App by manually entering the password, Touch ID / Face ID sensor will be disabled for Citi Mobile® App. This will not impact any other Touch ID / Face ID enrollment you have on your device.

- I have 5 fingerprints and 2 face profile IDs stored in my phone. Do all have them have access to my Citibank account?

Touch ID / Face ID recognizes all fingerprints / face profiles registered in your device. For security reasons, we recommend that you do not register third party finger prints or face profile in your device. This is to protect not just your Citibank account but the rest of your personal details in your phone.

- Will Touch ID / Face ID sensor work when I am overseas?

No, Touch ID sensor will not work if the service provider has changed in the overseas country.

- Will Touch ID / Face ID Sensor for Citi Mobile® App be disabled once I change my mobile number?

Changing the mobile number will not disable Touch ID sensor as long as SIM card and the service provider remains the same.

- Why was my Touch ID / Face ID Turned off?

There are a few reasons why your Touch ID may have been turned off:

1. You have changed your service provider

2. You have recently changed your User ID or Password

3. You have not logged into your Citi Mobile® App by entering your password for the past 45 days

4. You might have changed your SIM card

5. Your online account is locked because you have exceeded the maximum number of password tries

6. You have entered the wrong OTP when signed on for 3 times

7. You have enabled Touch ID sensor for your account on a different device

8. Your Citibank User ID is deleted in our system

- What is Notification?

Instead of via SMS or email, it is a new way of receiving alerts.

- If it's my first time enabling for Notifications, will I still be receiving SMS alerts?

No, Notifications will automatically replace some SMS alerts you currently receive. These include:

1. Account Credit via GIRO/Interbank Transfer Alert (when there is a money payment, which was made via GIRO/Interbank Transfer to you by someone, has been credited to your account)

2. 95% Credit Limit Reached Alert (when you have spent 95% of your credit limit with your credit card)

3. Credit Card/Ready Credit Payment Received Alert (when your Credit Card/Ready Credit Payment is received by the bank)

4. Time Deposit Maturity Alert (4 business days prior to your Time Deposit dues)In order to enable above alerts to be also received via SMS, please change your alert settings via logging into Citibank Online.

- If I want to receive my alerts via SMS and Notifications, what should I do?

If you have already enabled Notifications, you can also enable SMS alerts. Simply log in to Citibank Online and follow this path: Services > Citi Alerts > Modify Alerts > Edit.

- Besides SMS and Notifications, can I also receive alerts via email?

Yes. Simply log in to Citibank Online and follow this path: Services > Citi Alerts > Modify Alerts > Edit > Choose the alert you wish to receive via email.

- I have changed my mobile phone. Will I see my past Notifications on my new mobile phone?

No, notifications cannot be moved from one phone to another. They will only be retained in your original phone for 30 days after you have received it.

- Why am I unable to enable Notifications on my secondhand mobile phone?

This happens when the previous owner is a Citibank customer who has not disabled his/her Notifications on this mobile phone. Notifications are paired only to one user at any one time. To enable Notifications for yourself, delete and reinstall this app.

- I lost my mobile phone. How can I disable Notifications?

There are two ways you can do it:

1. Enable Notifications on your new phone

2. Call CitiPhone Banking at (65) 6225 5225 - How do I disable Notifications before I sell my mobile phone?

Simply log in to this app and follow this path: Settings > Notifications > Disable Notifications.

- Why can't I receive Notifications in China?

If you are using an Android mobile phone, you will not be able to receive Notifications in China. iPhone users will still be able to receive Notifications.

- Why did I suddenly stop receiving Notifications?

There may be a few reasons:

1. Your mobile phone is not connected to WiFi or mobile data networks

2. Your Citi Mobile® App is deleted

3. Your Citi Mobile® App is not upgraded with the latest version

4. Your Notifications are disabled

5. You have downloaded Citi Mobile® App and enabled Notifications on other mobile phones - How can I register for Push Notification?

Step 1: Sign on to Citi Mobile® App.

Step 2: Select the “Profile” button located in the top left hand corner > Under App Settings select “Alerts & Notifications”

Step 3: Tap “Enable”

Step 4: Select Notification Type you want to be notified on and click “Save”. - I have de-enrolled for Push notification and now I want to enroll back, will my SMS Enrollment be deactivated again?

No, your enrollment status for SMS alerts will not be affected.

Your SMS alert delivery via SMS will be automatically switched off if you are enrolling for Push Notification for the first time. After that, any changes made to your Push Notification enrollment will not affect your settings for receiving SMS alerts.

- How will my Email Notification be impacted by enrolling for Push Notification?

It will not impact your Email Notification. You will continue to receive your email notifications.

- I don't want to receive all types of alerts via push notification. Can I receive some alerts via Push Notification and some alerts via SMS?

Yes, you can receive some alerts via Push Notification. If you are already enrolled for Push Notification, you can manage your Push Notification & switch on your SMS alerts for certain type of alerts by following below steps:

To Enroll for SMS alerts, you need to login to Citibank online -> Services -> Citi Alerts -> Modify Alerts -> Edit.

Step 1: Sign on to Citi Mobile® App.

Step 2: Select the “Profile” button located in the top left hand corner > Under App Settings select “Alerts & Notifications”

Step 3: Tap “Enable”

Step 4: Select Notification Type you want to be notified on and tap “Save”. - I want to receive my alerts via both SMS and Push Notifications, what should I do?

If you have already enrolled for Push Notification, you can also enroll for SMS alerts simultaneously.

To Enroll for SMS alerts, you need to login to Citibank online -> Services -> Citi Alerts -> Modify Alerts -> Edit.

- I have registered for Push Notification but still some of the alerts are coming via SMS

It takes one working day for the enrollment to be activated.

- If I change my alert threshold limit in Citibank Online, will it change the threshold limit for SMS and Email notification for the same alert?

Changing the threshold limit in Citi Mobile® App will change the limit across all types of alert delivery including SMS and Email.

For example, if your current 'online transaction' threshold limit is $50 and you are changing the limit to $200, going forward all alerts will be received for transactions that are greater than $200.

- I want to de-enroll from Push notification for a few alerts from Citi Mobile® App, will SMS Notification be enrolled automatically?

De-Enrolling for Push Notification will enable your enrollment for SMS alerts automatically. Customers will have to manually enroll for SMS alerts by following below steps.

Log into Citibank Online -> Services -> Citi Alerts -> Modify Alerts -> Edit. - Where will I see the alerts that has been sent to my mobile phone via Push Notification?

'Notification Centre', which is an in-app repository in Citi Mobile® App, stores all your Push Notifications that were received on your mobile phone.

'Notification Centre' can be found in the menu of Citi Mobile® App.

- How long will the alerts be stored in the app and how can I delete these messages?

If you are an iPhone (IOS) user & you have not logged into your Citi Mobile® App for the past 30 days, any Push Notifications that been received during this period will not be stored.

If you are using an Android Phone, any push notification message that sends to your phone will be stored within the Citi Mobile® App indefinitely.

You will not be able to delete any notification from your Citi Mobile® App. But if you uninstall the app, all your notifications will be removed. If you re-install the Citi Mobile® App subsequently, then features such as Push Notification, Touch ID and Snapshot will need to be enrolled again.

- I am an iPhone user and why do I need to login to Citi Mobile® App to see my alerts

If you are an iPhone user, you are required to login into your Citi Mobile® App with your User ID and Password to view your Push Notifications. This feature provides extra security to ensure that only the actual user is allowed to see the content of the Push Notifications sent to you.

- I am an iPhone user but and I am not able to see some of my Push Notifications that I received 30 days ago.

For iPhone users, if notifications are received when the app is not running in the background, they will not be stored in the Notification Centre. Therefore, we suggest customers to log in to the Citi Mobile® App and check their Push Notifications on a frequent basis.

- Why am I suggested to open the app every 30 days to view my notifications?

All iPhone users who have enrolled for push notification are suggested to login to Citi Mobile® App every 30 days. If notifications are received when the app is not running in the background, they will not be stored in the Notification Centre. In that case, customers are required to log in to the Citi Mobile® App and check their Push Notifications on a regular basis.

- Apart from SMS & Push Notifications, can I receive banking alerts via Email?

Yes, you can. You can enroll to receiving banking alerts via Email by following the below steps:

Log into Citibank Online -> Services -> Citi Alerts -> Modify Alerts -> Edit -> Choose the alert that you would like to be received via emails. - I have changed mobile phone and I want to see all my old Push Notifications on my new phone.

Push Notification cannot be moved from one phone to another. Push Notifications will only be retained in your old phone for 30 days after you received it.

- I am an Android user and do I need to login to Citi Mobile® App to view my Push Notifications received?

No, you don't have to. For Android users, Push Notifications can be viewed in Notification Centre without logging into Citi Mobile® App.

- How do I download the Citi Mobile® App?

If you are reading this on your smartphone,

Click here to download the Citi Mobile® App directly.

Alternatively, you can download the app via one of the following methods:

* Search for "Citibank SG" in the App Store or Google Play on your smartphone

- What iOS/Android versions are compatible with the Citi Mobile® App?

Citi Mobile App is supported by iOS/Android version: iOS 9, Android 4.4 and above.

- How secure are the transactions I make with this new interface?

Your security is always our priority. All our services are rigorously and regularly tested before and after new version releases.

Rest assured that any transaction you make with our new interface is as secure as the rest of our banking platforms.

- Why am I not seeing Citi Mobile® Snapshot on this new interface?

With our new and improved Dashboard design, you no longer need Snapshot as you can enjoy instant access to your account information upon login.

- Can I make purchases at Visa/MasterCard acceptance merchants without activating my Credit or Debit card?

No, your will not be able to make purchases. This includes online transactions made over the internet and within apps. However, recurring bill payment instructions effected with merchants will still be processed.

- Can I make ATM cash withdrawals without activating my Credit, Debit or ATM card?

No, you will not be able to make ATM cash withdrawals.

- If my cards are locked, will my recurring bill payments be affected? For example, the auto-debiting of my Citibank Credit Card/ Ready Credit Account for monthly phone bills.

Monthly recurring bills will continue to be charged to your locked Citibank credit card/ Ready Credit account.

- After successfully activating my card, can I use it immediately?

Yes, you will be able to use your card immediately. You will receive a confirmation SMS upon the successful completion of the card activation steps.

- I recently changed my mobile number and have yet to update Citibank. Can I still activate my cards?

No, you must update us to activate your cards using SMS, Citi Mobile®, Citibank Online or Self Service Phone Banking. Please call 6225 5225 and our CitiPhone Officer will happy to assist you.

- If my card is locked, can I pay outstanding Citibank bills on my Citibank Credit Card/Ready Credit Account?

Yes, you will still be able to do so.

- If my Citibank Credit Card or Ready Credit ATM Card is locked, will I still be able to log in to Citibank Online? What online functions can I still access if my card is de-activated?

Yes, you will still be able to log in to Citibank Online. You may access all available functions except for Payment/Transfers.

- What are Overseas Transactions?

They are any of the following: (i) Overseas ATM cash withdrawals using a Citibank ATM Card

(ii) Overseas ATM cash withdrawals and Overseas Point of Sale Transactions using a Citibank ATM/Debit Card and

(iii) Overseas ATM Cash withdrawals and Overseas Point of Sale Transactions on magnetic stripe terminals using a Citibank Credit Card or Citibank Ready Credit Card. - Which countries do not accept the EMV chip?

Selected merchants in the UK, Europe, Australia, Japan, Taiwan, Hong Kong and Malaysia accept the EMV chip. In the US and South Korea, merchants are still reliant on the magnetic stripe to process credit and debit card transactions. As such, we recommend activating the magnetic stripe on your cards when you travel overseas.

- Without enabling overseas use on my ATM/debit/credit card, will I be able to perform Overseas Transactions?

No, you will not be able to.

- How do enable/disable overseas use on my ATM/debit/credit card?

You may do so via SMS, Citi Mobile®, Citibank Online and Self Service Phone Banking.

- Do I have to re-enable my ATM/debit/credit card for overseas use each time I travel?

No, once you enable your cards for overseas use, it remains enabled until you disable it.

- Can I limit overseas use on my debit/credit card to just ATM cash withdrawals and exclude debit/credit card transactions?

No, enabling overseas use will enable both ATM cash withdrawals and debit/credit card transactions.

- If I replace my ATM/debit/credit card which has been enabled for overseas use, will overseas use remain enabled on my replacement card?

Yes, it will remain enabled on your replacement card.

- Can I enable my ATM/debit/credit Card for overseas use even when I am already travelling?

Yes, you may do so via SMS, Citi Mobile®, Citibank Online and Self Service Phone Banking. Once your ATM/debit/credit card has been enabled, you will receive an SMS confirmation.

- What happens if I don't receive an SMS confirmation after I have enabled my ATM/debit/credit card for overseas use?

You will receive an SMS notification only on the mobile number you have registered with Citibank. Please log in to www.citibank.com.sg to check that the mobile number in your profile corresponds to your current mobile number. Call our 24-hour CitiPhone Banking hotline at +65 6225 5225 to update your records.

- How do I view the daily currency update?

For Android users, the daily currency update will be downloaded onto your mobile phone as a separate document in pdf format .

For IPhone users, the document will be displayed in your browser.

- What is ATM PIN reset?

You can now change your ATM, Debit and/or Credit card PIN on the go using your Citi Mobile® App

- What is different about the Payments and Transfers (PNT) function?

Going forward customers are required to choose the source of fund (SOF) account first and then based on the selected SOF, the destination account will be displayed.

- What has been changed on the main dashboard search function?

Here are the new capabilities introduced:

Search transaction using Date (Up to 150 transactions performed in the last 3 months)

Search transactions using Amount

Search transaction using Transaction type - How many transactions can I see at once?

You will be able to see 150 transactions for each account.

- Can I delete my remembered User name?

Yes you can delete your remembered User ID by clearing cache in android phones and for apple devices, you can do so by deleting and re-installing the app.

Citi Mobile®App Terms and Conditions

# Instant disbursement is available only for Citibank Deposit Accounts displayed during the funds disbursement option.

For payments and transfers via Citi Mobile, the payee will first have to be added on Citibank Online and activated with an Online Authorisation Code (OAC). All payments and transfers are subject to the Citibank Online User Agreement. Some or all of the services (including payments and transfers) that may be accessed through Citi Mobile or Citibank Online may not be available during our scheduled maintenance times. In the event of such unavailability, you may call our 24-Hour CitiPhone Banking at 6225 5225 or visit a Citibank branch to conduct your banking transactions. Citibank exercises no control and assumes no responsibility for any delay, misconnection, variation in response times and connectivity of any Internet Service Provider (whether local or overseas) through which access to Citi Mobile and/or Citibank Online is effected. Citibank full disclaimers, terms and conditions apply to individual products and banking services.

Citigroup.com is the global source of information about and access to financial services provided by the Citigroup family of companies.

Copyright © 2019 Citigroup Inc.

No content.